What Do Soaring NBA Franchise Values Tell Us About MLB?

News broke Sunday night that the Maloofs — the majority owners of the National Basketball Association’s Sacramento Kings — agreed to sell their share of the team to Seattle investors, including Microsoft CEO Steve Ballmer and investor Chris Hansen. The Seattle group valued the franchise at $525 million, and agreed to pay $340 million for the Maloof family’s 65% stake. Sacramento mayor and former NBA star Kevin Johnson is working to assemble a counter-bid to keep the team in California while minority investors may sue and claim a breach of the limited-partnership agreement. In other words, the $525 million value is likely to go up before this is done.

Just days later, Forbes published its annual story on NBA franchise values, and ranked the Kings as the 11th-most-valuable franchise, using the $525 million figure from the proposed sale. But the Kings weren’t the only NBA team to see its value rise significantly in the past year. For the first time, Forbes valued two teams at $1 billion or more — the New York Knicks (at $1.1 billion) and the Los Angeles Lakers (at $1 billion) — and pegged the average franchise value at $509 million, a 30% increase over 2012. Forbes also reported the average operating income (earnings before taxes, depreciation, etc) for the NBA’s 30 teams was $11.9 million, the highest since Forbes started tracking the numbers in 1998.

So what’s driving the NBA’s financial success, and what does it foretell for Major League Baseball teams’ values when Forbes releases that list in March?

The Forbes report points to several key factors; the biggest one being the collective bargaining agreement that took effect in late December 2011. The owners had locked out the players and several weeks of the 2011-2012 season had been canceled. Not surprisingly, the new agreement resulted in a substantial shift in money from the players to the owners. Unlike its MLB counterpart, the NBA collective bargaining agreement mandates a specific division of Basketball Related Income (BRI) between players and owners. BRI include team income generated through ticket sales, local TV deals, sponsorships, arena naming rights, concessions and parking — as well as income generated centrally through NBA Properties and NBA Media. Under the previous NBA agreement, owners were guaranteed 43% of BRI, with players getting 57%. That’s now shifted to a near 50-50 split. Overall NBA income is estimated at $5 billion.

The new agreement also strengthened the revenue-sharing program and raised tax rates considerably for teams spending over the luxury tax threshold. Those changes stabilized small market teams — like the Memphis Grizzlies and the New Orleans Pelicans (nee Hornets) — both of which sold last year for more than $300 million.

Another big factor driving up NBA franchise values are lucrative new TV deals, locally and nationally. The Los Angeles Lakers’ new deal with Time Warner Cable sets the gold standard (not unlike the Dodgers’ new local TV deal) and will pay the team $180 million per year for 25 years. The Boston Celtics have a new deal, too, which will pay the team $70 million per year when it goes into effect in 2017. The Golden State Warriors received a $50 million up-front fee in 2011 in its new deal and tripled its yearly rights fee from $9 million to $25 million. On the national level, the NBA is still operating under agreements with ABC/ESPN and TNT that pay a combined $930 million annually, but that fee is expected to more than double when the current agreement expires after the 2015-2016 season.

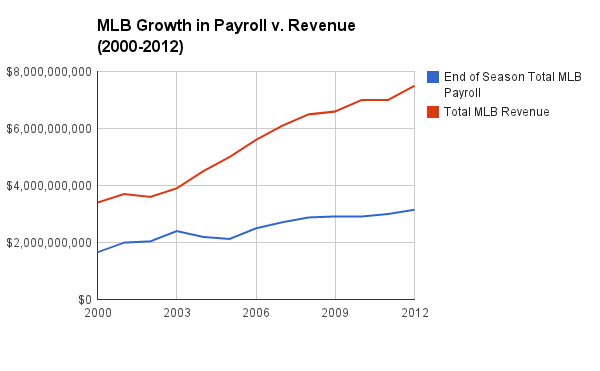

If a shift of money from players to owners, a more robust revenue-sharing and luxury-tax program, and new, lucrative TV deals are driving up NBA franchise values, then we should expect MLB team values to jump significantly in Forbes‘ March study. While the NBA’s money shift toward owners was specifically bargained for, MLB owners have enjoyed an even larger percentage of the overall baseball pie in the past 10 years. I discussed this last week in a post and included this chart that showed growth in MLB revenue, versus MLB total payrolls from 2000 to 2012.

What that chart implies, but doesn’t explicitly show, is the change since 2003 in the ratio of payroll to revenue. In 2003, total MLB payrolls were 62% of total MLB revenue. The next year, that number dropped to 49% and has been falling ever since. In 2012, payroll was only 42% of revenue. That 58%-42% split for the owners far surpasses what the NBA owners achieved in the collective bargaining process.

Like the NBA, baseball also strengthened its revenue-sharing and luxury-tax programs in the most recent collective bargaining agreement, as I’ve explained in several posts. You can read those details here and here. One key change to MLB’s revenue-sharing system is its flexibility to capture big increases in team revenue when a new local TV is signed. I explained how that works here. We know local TV broadcast fees are skyrocketing, and it’s not just the Dodgers. The Rangers, Angels, Astros and Padres have new billion-dollar deals. The Phillies, Rockies, Diamondbacks and Mariners are negotiating new deals now. That money will flow through the revenue-sharing pipeline to the benefit of small-market teams.

On the national level, MLB will enjoy the fruits of its new contracts sooner than the NBA. Starting in 2014, ESPN, TBS and FOX will pay a combined $1.5 billion per year to the league; that’s $25 million in additional revenue for each team over the eight-year life of the contracts.

NBA franchise values are way up from 2012. That appreciation in value is driven by the structure of the new collective bargaining agreement, the explosion in local TV revenue and the expected doubling of national TV revenue. Major League Baseball enjoys a similarly-favorable collective bargaining agreement, more new lucrative local TV deals and a new national TV contract set to start next year. Expect to see significant increases in MLB franchise values when Forbes releases its report in March.

Wendy writes about sports and the business of sports. She's been published most recently by Vice Sports, Deadspin and NewYorker.com. You can find her work at wendythurm.pressfolios.com and follow her on Twitter @hangingsliders.

It tells me to expect ticket prices and prices of advertised stuff to go up.

No. Ticket prices are determined by the market, and optimizing it’s potential revenue.

Hope I didn’t read the comment wrong but one of the worst things I heard during the recent NHL lockout were fans and pundits bemoaning the players cause the effect of their extra salary would have to be levelled on ticket prices and hot dogs.

If the teams could charge more for things they would.

Why? I’m not following this. The things that would correlate to higher tix prices would be measurements of demand. Spikes in season ticket sales or having a lot of sell outs. The cable bubble doesn’t really have much bearing unless there is a significant increase in viewership, but even that might mean lower attendance due to it being a substitute.

It tells me cable and satellite packages will continue to climb as these corporations pay out more.