How Sinclair’s Purchase of Baseball Sports Networks Will Affect You

Near the end of 2017, reports surfaced of a massive deal that would see Disney buy more than $50 billion in FOX assets, including 22 regional sports networks that broadcast the games of about half of the 30 major league baseball franchises. After a bidding war between Comcast and Disney saw the latter win out, moves needed to be made to satisfy antitrust concerns. Given Disney’s already powerful place in the market with its ESPN family of channels, one of those moves included the sale of those regional sports networks. The first domino fell in March when the Yankees agreed to buy back the YES Network at a total valuation of around $3.5 billion dollars. Now, the remaining dominoes appear to have fallen, with the Wall Street Journal first reporting that Sinclair Broadcasting Group has agreed to buy the remaining 21 networks, valued at $10.6 billion.

The networks included in the deal are as follows:

| Team | Network |

|---|---|

| Angels | Fox Sports West |

| Braves | Fox Sports South/Southeast |

| Brewers | Fox Sports Wisconsin |

| Cardinals | Fox Sports Midwest |

| Diamondbacks | Fox Sports Arizona |

| Indians | Fox SportsTime Ohio |

| Marlins | Fox Sports Florida |

| Padres | Fox Sports San Diego |

| Rangers | Fox Sports Southwest |

| Rays | Fox Sports Sun |

| Reds | Fox Sports Ohio |

| Royals | Fox Sports Kansas City |

| Tigers | Fox Sports Detroit |

| Twins | Fox Sports North |

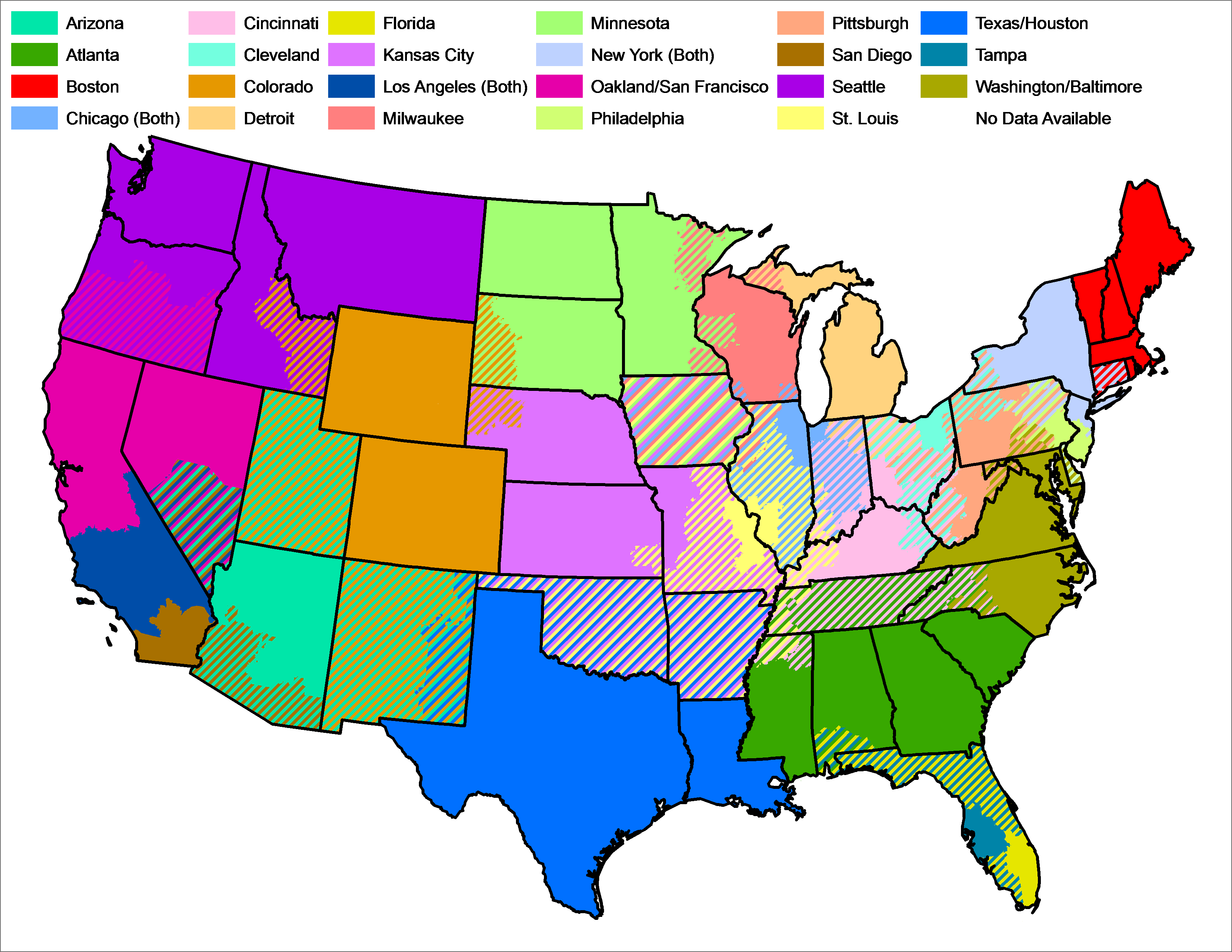

Including the Cubs and the Yankees, Sinclair will likely control distribution for 16 of the 30 major league franchises. That could pose problems for fans trying to watch their favorite team. To provide an idea of the breadth of Sinclair’s reach, below is an old, but mostly accurate, map of MLB’s territorial broadcast rights, which is relevant to fans for two reasons.

- The map shows where fans will be blacked out of team broadcasts if they buy an MLB.TV package.

- The map shows which areas teams are allowed to sell local broadcast rights, though many of those areas don’t actually have many, or any, local broadcasts even if a fan were willing to pay.

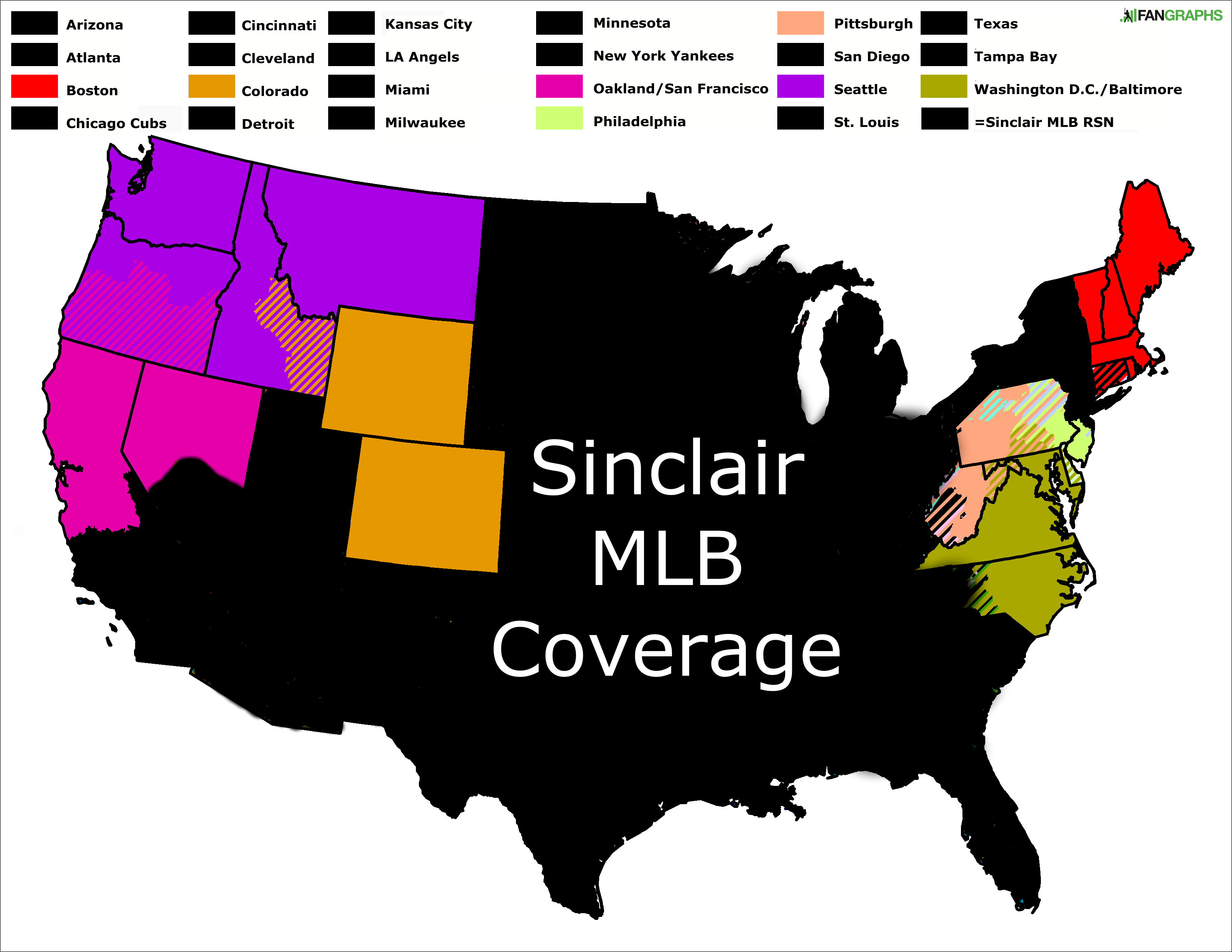

Now, here’s a map showing Sinclair’s new broadcast territory.

Note that the Astros, Dodgers, Mets, and White Sox don’t appear above due to overlapping coverage with a Sinclair property.

The map doesn’t necessarily represent a problem for baseball; the same map without Chicago could have been showing FOX’s channels heading into the year. Rather, it’s Sinclair’s business model that could cause headaches for both Major League Baseball and fans in the coming years. Sinclair’s main business prior to their entry into sports has been owning local broadcast television stations in mostly smaller markets. While many of the channels aren’t the biggies, Sinclair owns many ABC, CBS, FOX, NBC, and CW affiliates throughout the country. Consider their market penetration for just those networks. The country’s top 20 broadcast markets make up 45% of all households; Sinclair broadcasts to just 12% of that population with stations in Washington, D.C., Seattle-Tacoma, and Minneapolis-St. Paul. In the remaining 55% of households in markets outside the 20 biggest, Sinclair owns television stations that broadcast to 61% of homes.

Remaining outside of the top 20 markets wasn’t necessarily Sinclair’s strategy. The group attempted to merge with the Tribune, owners of stations in New York, Los Angeles, and Chicago and multiple other large markets. However, even after FCC relaxed rules on network ownership, the deal fell through because the proposed merger would violate the law, according to FCC Chairman Ajit Pai. As it stands, Sinclair is at the cap of the 39% market reach allowed by the FCC. If they want to reach more markets or expand in their current markets, they have no other option except for cable channels. While this deal for baseball RSNs, as well as ownership stakes in the Cubs’ and Yankees’ networks, does put Sinclair in larger markets like New York, Chicago, Los Angeles, and Dallas, that is less likely to be problematic for baseball and its fans than it is in areas where Sinclair already owns stations.

The Wall Street Journal piece that broke the news of this purchase included a quote from a former senior vice president with Fox Sports.

“Sinclair got a great deal and should be able to cut costs and leverage the RSN’s and their stations together effectively” with distributors and advertisers, said Patrick Crakes, a sports media consultant.

Both parts of that quote are potentially bad for baseball fans. Cutting costs could mean a lot of things, one of which might be that fans get a less original and local programming focused on their own team and more generic national coverage, or no sports coverage at all during some blocks of the day. But while cost-cutting is troublesome, more worrisome is Sinclair leveraging the RSNs with their other stations. Sinclair has a history of blackouts from when it attempted to utilize the same practices with its prior sports network, the Tennis Channel, resulting in customers losing local programming. Now, Sinclair won’t be saddled with trying to negotiate a better deal for a niche national channel. Instead, they will have a very popular local sports channel that gets good ratings.

Here’s one example of how it could work:

In Cincinnati, Sinclair owns the local CBS and CW stations. When negotiating with Spectrum, the main cable provider in Cincinnati, it could provide an all-or-nothing option. If Spectrum isn’t willing to pay more to put all three channels on, it gets none of them. This practice, known as bundling, has been going on for years, and it might also be part of the reason why cable prices have continued to go up as companies lose subscribers. The best-case scenario here is that Spectrum pays the higher rate and then passes on higher prices to its consumers who then pay more for the same product. The other scenario involves the two sides failing to reach a deal, and customers being simply unable to watch Reds games.

The overlap between Sinclair-owned broadcast stations and the new RSNs is huge, and much of it is in areas of the country without much competition for cable providers. Of the 77 million US households now in Sinclair’s major league baseball territory (out of 110 million TV households across the country), the company owns broadcast stations serving 28 million households, or 36% of that territory. Removing only New York, Chicago, and Los Angeles puts the percentage of household overlap between a Sinclair broadcast station and a baseball RSN at 46%. The table below shows every market in which Sinclair owns a broadcast station and now controls distribution for a major league team. The list is grouped together by team but is sortable. Team designations come from checking your team’s local listings.

| DMA | Team | DMA Rank | Homes | Local Stations |

|---|---|---|---|---|

| Bakersfield, CA | Angels | 122 | 215360 | CBS, FOX |

| Las Vegas, NV | Angels | 39 | 766500 | NBC, CW |

| Gainesville, FL | Rays, Marlins | 157 | 120580 | NBC, CBS |

| West Palm Beach-Fort Pierce, FL | Rays, Marlins | 37 | 829880 | CBS, CW |

| Talahassee, FL, Thomasville, GA | Rays, Marlins, Braves | 112 | 237940 | NBC, CW |

| Albany, GA | Braves | 152 | 130950 | FOX |

| Birmingham, AL | Braves | 43 | 679550 | ABC, CW |

| Charleston, SC | Braves | 94 | 302330 | ABC |

| Chatanooga, TN | Braves | 83 | 341190 | ABC, CW |

| Columbia, SC | Braves | 74 | 389590 | FOX |

| Florence-Myrtle Beach, CA | Braves | 95 | 302040 | ABC, CW |

| Greensboro-High Point-Winston-Salem | Braves | 46 | 675130 | ABC |

| Greenville-Spartanburg, SC, Asheville, NC, Anderson, SC | Braves | 38 | 805920 | ABC |

| Greenville-New Bern-Washington, NC | Braves | 107 | 261830 | FOX, ABC |

| Macon, GA | Braves | 118 | 224180 | ABC, FOX |

| Mobile, AL-Pensacola, FL | Braves | 58 | 524390 | ABC, NBC |

| Nashville, TN | Braves | 27 | 1021780 | FOX, CW |

| Raleigh-Durham, NC | Braves | 25 | 1108710 | CW |

| Savannah, GA | Braves | 93 | 303390 | FOX |

| Tri Cities, TN/VA | Braves | 102 | 266110 | NBC, FOX, CW |

| Puducah, KY, Cape Girardeau, MO, Harrisburg, IL | Braves, Cardinals | 88 | 324020 | FOX |

| Columbia-Jefferson City, MO | Cardinals | 136 | 156430 | CBS |

| Des Moines-Ames, IA | Cardinals | 75 | 383590 | FOX |

| Lincoln-Hastings-Kearney, NE | Cardinals | 111 | 240660 | ABC, FOX |

| Quincy, IL, Hannibal. MO, Keokuk, IA | Cardinals | 174 | 88510 | ABC, CBS |

| St. Louis, MO | Cardinals | 21 | 1164400 | ABC |

| Champaign-Springfield-Decatur, IL | Cardinals, Cubs | 82 | 344500 | ABC, FOX, CW |

| Ottumwa, IA, Kirksville, MO | Cardinals, Cubs | 200 | 40840 | ABC, CBS |

| Cedar Rapids-Waterloo-Dubuque, IA | Cubs | 87 | 330340 | CBS, FOX |

| South Bend-Elkhart, IN | Cubs | 99 | 274380 | CBS, FOX |

| Green Bay-Appleton, WI | Brewers | 67 | 421480 | FOX, CW |

| Madison, WI | Brewers | 86 | 338240 | FOX |

| Milwaukee, WI | Brewers | 36 | 848420 | CW |

| Columbus, OH | Indians, Reds | 34 | 889600 | ABC, FOX, CW |

| Toledo, OH | Indians, Reds | 71 | 401510 | NBC |

| Cincinnati, OH | Reds | 35 | 850030 | CBS, CW |

| Dayton, OH | Reds | 64 | 463430 | ABC, FOX |

| Lexington,KY | Reds | 63 | 464340 | FOX |

| Abilene-Sweetwater, TX | Rangers | 165 | 104440 | ABC, CW |

| Amarillo, TX | Rangers | 131 | 175880 | ABC CW |

| Austin, TX | Rangers | 40 | 751650 | CBS |

| Beaumont-Port Arthur, TX | Rangers | 140 | 152710 | CBS, FOX |

| Corpus Christi, TX | Rangers | 128 | 193070 | FOX |

| El Paso, TX | Rangers | 85 | 338770 | CBS, FOX |

| Harlingen-Weslaco-Brownsville-McAllen, TX | Rangers | 78 | 375600 | CBS |

| Little Rock-Pine Bluff, AR | Rangers | 57 | 527090 | ABC |

| Oklahoma City, OK | Rangers | 45 | 676720 | FOX, CW |

| San Angelo, TX | Rangers | 196 | 52790 | ABC, CW |

| San Antonio, TX | Rangers | 31 | 923990 | NBC, FOX, CW |

| Tulsa, OK | Rangers | 61 | 508550 | ABC |

| Omaha, NE | Royals | 69 | 405260 | FOX, CW |

| Wichita-Hutchinson, KS | Royals | 76 | 382780 | FOX |

| Flint-Saginaw-Bay City, MI | Tigers | 65 | 430660 | NBC, FOX, CW |

| Grand Rapids-Kalamazoo-Battle Creek | Tigers | 49 | 639410 | CBS, CW |

| Traverse City-Caddilac, MI | Tigers | 120 | 218520 | ABC, NBC |

| Minneapolis, MN | Twins | 15 | 1713310 | CW |

| Sioux City, IA | Twins | 149 | 135660 | CBS, FOX |

| Albany-Schenectady-Troy, NY | Yankees | 59 | 520540 | CBS, CW |

| Buffalo, NY | Yankees | 52 | 586930 | FOX |

| Rochester, NY | Yankees | 80 | 352070 | FOX, ABC |

| Syracuse, NY | Yankees | 81 | 350730 | NBC |

That’s more than a quarter of all households in the United States potentially affected by a blackout or higher prices. That number could be higher if Sinclair tries to bundle across markets, by say, not allowing Comcast in Chicago to get Cubs games unless they pay a certain price for Braves games in Atlanta and Tigers games in Michigan. It was this type of dispute that caused CBS to undercut Sinclair in negotiations with Hulu. It appears almost no matter what Sinclair does, there are likely to be testy negotiations and factors beyond the popularity of the sport that will determine whether or not fans get to see their local team.

As to the purchase price, that combined $14 billion for these Sinclair purchases plus the value of YES is about a third shy of the estimated $22 billion Guggenheim put on the RSNs in December 2018. There are several potential reasons for the drop in price outside of, or in addition to, a wary future for cable. One is the lack of competition. Disney was forced to sell the networks due to anti-trust concerns and Comcast, which was also bidding against Disney for the FOX assets, made a similar pledge to get past regulators. With FOX not interested in buying back the networks, there were very few potential media companies that could reasonably buy the RSNs. Removing the Yankees from the equation might have driven the total price down. Of the 14 teams remaining, six (Cleveland, Detroit, Kansas City, Miami, Milwaukee, Minnesota) have deals coming up in the next five years. Without the rights to broadcast baseball long-term, the networks could become near-worthless.

The other factor that might have driven the price down, and also creates confusion for the future, is that major league teams retain streaming rights to their games locally. In theory, streaming rights are potential competition for rights to broadcast on a network as an alternative format to watch games. In practice, teams will likely negotiate streaming rights with whichever company is broadcasting their games. The streaming rights are a potential ace-in-the-hole to make sure fans can still watch games if Sinclair, NBC, AT&T, Time Warner or whichever entity broadcasts the games doesn’t negotiate a deal with cable providers. However, the broadcaster is the one creating the broadcast to be streamed, and creating a second broadcast isn’t feasible. That quagmire is why it might have made a lot of sense to purchase the RSNs themselves in order to retain control over both negotiations with cable providers, ensuring the team’s broadcast is available along with the ability to have games streamed should those negotiations break down. Handing the negotiations over to Sinclair is wrought with peril given their past negotiating tactics and their likely strategy for the future. This deal is a step backward for baseball as it becomes increasingly reliant on a company that operates in a confrontational and potentially outdated manner that risks alienating fans, who may lose coverage of their local team without receiving an alternative means to watch baseball and grow the sport.

Craig Edwards can be found on twitter @craigjedwards.

Also, Sinclair is an awful company that forces its local news affiliates to run pre-writtin pro-Republican propaganda op-eds. I just can’t wait for announcers doing their mid-game reads extolling the virtues of Supreme Leader Trump.

The combination of the white Sox going to the White House and Sinclair buying baseball broadcasts is a pretty ugly thing.

Not sure why you’re getting downvoted.

Oh, wait, I know why.

Drones, most of them. Orange man bad, etc.

Maybe they should air footage of all of the first-pitches he’s thrown to inspire us.

Exactly – imagine this smack in the middle of your baseball watching experience:

https://m.youtube.com/watch?v=_fHfgU8oMSo

No thanks. Been on the fence about cancelling our cable package, and this purchase might have just made the decision for us.

It’s pro-Trump propaganda, not pro-Republican. No real Republican would support tariffs, alienating our allies, and ignoring foreign threats to the integrity of our elections, among a host of other issues.

90% of “real Republicans” are doing exactly that. wake up,

I must have missed the part where they were opposing literally anything the White House does.

…unless they’re in Congress

No real Republican would be supporting a guy like Trump, or so we thought. As it turns out, the GOP is remarkably devoid of convictions.

It’s fashionable to assert that political parties are a bundle of policy positions rather than an identity itself, but the “identity” is the best way to think about it here. You can see that in the number of Republicans who have suddenly adopted Trump’s positions, and and you can also see this in the people who disaffiliate with the Republican party because they don’t want to be associated with Trump. They’re “conservative”, but no longer “Republican.” (This, by the way, is part of the reason why Trump’s approval rating is so high among Republicans).

I do not think anyone, regardless of their policy leanings and political tribal identity, can really disagree with that.

Any case, all of this is a digression from the possibility that Sinclair might be screwing more of us out of watching baseball, which is something that I hope everyone can agree is a bad thing.

One notices that Sinclair owns mostly red states so, uh, if you’re a Republican who’s cool with this, how you going to feel when you can’t get your baseball?

We all know what this article is about. The author (and many of the commenters) are left-wing, and they’re trying to invent non-partisan-sounding rationale for hating a network that doesn’t pander to the Left.

Any other buyer and this article isn’t written.

Come on, you can troll better than this!

I just want to watch baseball. I’d hate it if the network pandered in any political direction.

Indeed. I love me some single payer, but I absolutely, absolutely do not need that phrase ever mentioned close to my baseball watching ever. Like… not ever.

Single payer promotion: “We’ll send $100 to Mrs. Euphonia Brown of Anaheim if Trout gets a base hit. “

That explains about 85% of commenters on this site, that is true. However, ANY deal that allows a single company to control 39% of a market is a terrible thing. The ironic thing is, many of the commenters would actually support the government controlling 100% of this as long as they told them all that is will be ‘free’ to everyone.

Wow, there are people in the country that disagree with you politically! And some of those people own businesses!

Just the dumb ones.

I thought politics was frowned upon on this site? Looks like it’s only certain politics. What a surprise… /sarcasm

It should not be political to say it’s deeply problematic that a massive media company forces local news shows across the nation to air the exact same op-eds exclusively in favor of one party/politician.

Yeah. The party of “Republicans pounce” and “walls are closing in” complaining about newscasters being ideologically lockstep is hilarious in its lack of self-awareness.