Should MLB Worry About Its New Deal with ESPN?

In 2014, Major League Baseball roughly doubled its national television money in deals with ESPN, FOX, and TBS that expire at the end of this season. Over the last few years, new agreements with FOX and TBS created a nearly 50% increase in annual rights fees, totaling nearly $9 billion dollars from 2022 through ’28. Understandably, the general expectation was that MLB’s new contract with ESPN would follow suit with a similar jump, securing roughly $2 billion per year in national television money alone. But the league’s dreams have been dashed: As Andrew Marchand and Joel Sherman of the New York Post reported last month, ESPN’s rights deal will be smaller than its previous agreement, with Ken Rosenthal of The Athletic adding last week that the total package will be $3.85 billion for the next seven years — a substantial drop from the $5.6 billion over eight years that the Worldwide Leader forked over last time.

A decrease in rights fees to the tune of $150 million per year is going to raise alarm bells about the state of MLB, ESPN, and cable television on the whole. But while the decrease is cause for concern — and there are certainly some broader issues at work outside the sport — MLB still finds itself in relatively good position. To start, ESPN, FOX, and TBS will combine to pay MLB an average of $1.81 billion over seven years starting in 2022, an increase of 17% over the previous deal (and a growth in total value despite those earlier agreements being a year longer and a year from being over).

Even better for MLB, it still has rights to sell, with or without expanded playoffs. As reported by both the Post and The Athletic, the ESPN deal cuts in half the number of regular-season games broadcast by the network, essentially keeping Sunday Night Baseball and a few other marquee games as well as the Home Run Derby but ditching the majority of the weeknight games. If we assume ESPN keeps 40% of the TV rights from the previous deal and that there’s 40% more value in airing Sunday Night Baseball plus a little extra compared to the 50 or so Monday and Wednesday night games that are being let go, then the network will see a similar increase in cost as FOX and TBS.

The problem for MLB is that while those Monday and Wednesday night games do have some value, it likely won’t be as much as the $300 million or so ESPN was paying annually for them. As the Sports Business Journal has reported, FOX wasn’t interested in MLB’s asking price, and TBS (which will air a Tuesday night game starting in 2022) doesn’t want more mid-week games. To sell these games, MLB will need to lower its asking price with FOX, seek another traditional outlet like NBC or CBS (both of which have cable sports networks), or explore a streaming route like Netflix, Amazon, YouTube TV, or Hulu. Whether the league will have to settle for a fraction of ESPN’s prior price or get something close to it (or even increase it) remains to be determined.

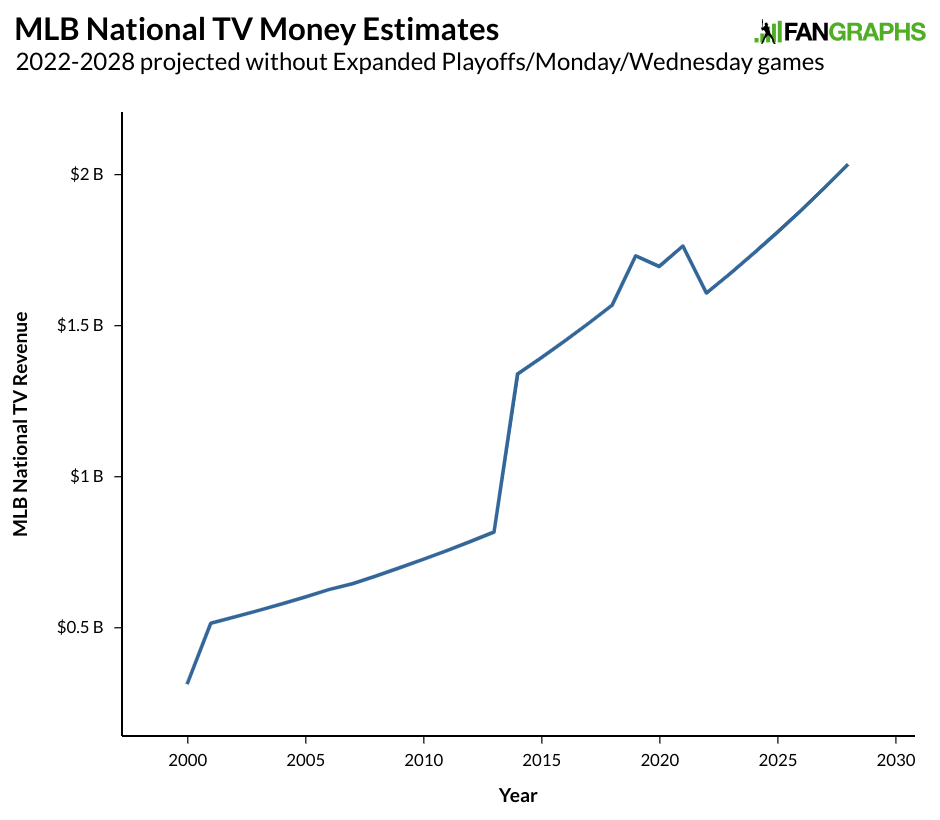

Without accounting for those rights or potential increases due to expanded playoffs, here’s what the national television money for MLB looks like for the past 20 years as well as through the end of the 2028 season. Note that DAZN’s three-year, $300 million contract was included for 2019 only with the assumption that no payments were made last year or in 2021, which might or might not happen. All long-term deals assume a 4% annual increase over the life of the contracts.

While it is isn’t likely to happen, if no deal for more weeknight games materializes, MLB could see a drop of over $100 million from 2021 to ’22. The good news for the league is that after that, it will move closer to the same financial trajectory it has been on for the past few decades: Once the smaller package of games is sold, the last section of the graph will move up and present a more continuous increase. It will likely move even higher if MLB gets its way with expanded playoffs.

ESPN, meanwhile, isn’t likely to see much in the way of revenue reduction as a result of this change: The network has a huge roster of live sports and is maintaining its already significant investment in baseball. ESPN could possibly devote more resources to MLS, whose rights deal expires in 2022, at a considerably lesser cost than MLB and still keep similar hours of live sports on air in the summer. The ESPN/MLB relationship is still a strong one, and the league still owns a 15% share of Disney-owned BAMTech, with ESPN’s corporate overlord purchasing 75% of the tech company for more than $2.5 billion in 2016 and ’17.

In his piece, Rosenthal also notes that the Marlins and Brewers still do not have rights fees locally for 2021. That pair of teams is already at the very bottom when it comes to local television revenue, and it will be interesting to see if they re-up with Sinclair Broadcast Group, which controls both RSNs. They might not have many other options anyway. MLB could step in, given that it has the capabilities and experience to run an RSN and was interested in buying them when they were up for sale a few years ago. Liberty Media could be interested in starting up some RSNs before potentially launching their own network with Atlanta. The most likely scenario, though, is a continuation with Sinclair and an increase in rights fees that doesn’t significantly change the fortunes of the two franchises. Nor will it alter baseball’s RSN landscape as a whole: A vast majority of franchises already have long-term deals and stakes in the networks that broadcast them. Cord-cutting, increases in streaming, and hardball tactics from Sinclair that increase blackouts on those services threaten the future of the game in the long-term, but in the immediate future, Sinclair is projecting nearly a billion dollars in revenues above expenses on their RSNs despite the pandemic.

The ESPN contract doesn’t look great on its face, but it isn’t as bad as it appears. MLB will still see an increase of its rights fees in these next sets of deals, and the league has some inventory it can sell in its mid-week games. Nationally, MLB is now also insulated from a collapse in rights fees for nearly a decade. And while there are some areas of concern locally, most of the league looks to be in very good shape for the next decade. The sport still faces questions about long-term growth, particularly when it comes to attracting new fans in a more segmented video marketplace, but this lessened ESPN deal shouldn’t be of great concern for the sport.

Craig Edwards can be found on twitter @craigjedwards.

Convenient that MLB has another excuse to cry poverty right before the new CBA negotiations begin.