Rumored Royals Sale Would Rank Among Most Profitable

On Tuesday, Ken Rosenthal and Jayson Stark reported that Royals owner David Glass was discussing a potential sale of the baseball team to John Sherman, who currently owns a minority interest in the Cleveland Indians. Jeff Passan is reporting the deal would be worth more than a billion dollars, which could potentially exceed Forbes’ estimate from earlier in the year. In very related news, Jeffrey Flanagan of MLB.com reported that the Royals are close to an extension of their television rights with Fox Sports Kansas City that were set to expire after this season. That deal, worth an estimated $50 million per season, looks light in relation to recent deals. Combined with the news of a potential sale, it seems possible the Royals have opted for a lesser television deal in favor of certainty in order to sell the team.

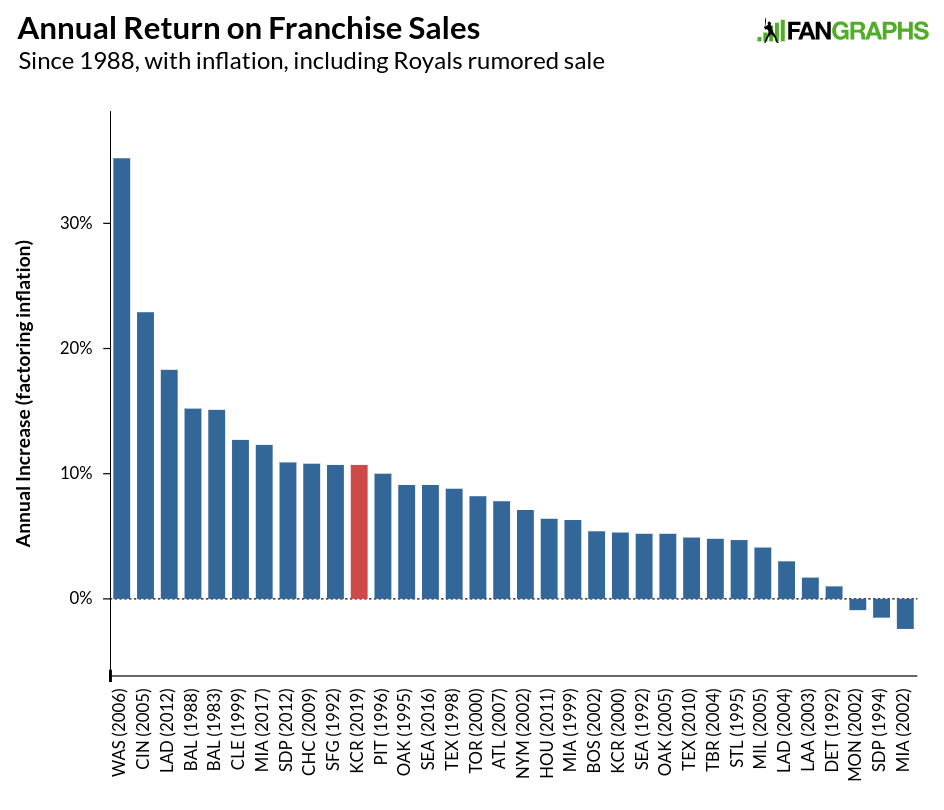

The potential television deal will be addressed later in this piece, but the bigger news is clearly the potential sale. Glass purchased the team for $96 million back in 2000, and if he were to sell the team for a billion dollars, it would be one of the most profitable sales in the history of the sport in sheer monetary terms. The graph below shows all sales of MLB franchises since the Orioles were sold back in 1988. During that time, every team except for the Yankees, White Sox, Twins, and Phillies have been sold, with the Diamondbacks and Rockies still with their original ownership group in some form. There have been 33 sales, with the Royals a potential 34th transfer.

The graph above can be a bit misleading as inflation and the amount of time a team has been owned can greatly affect the numbers above. The sale of the the Dodgers is still the biggest on the list, with the Mariners coming in second, and even after accepting a deal at only 75% of the rumored price, Jeffrey Loria’s profit on the Marlins was enormous. The average profit on a sale over the last 30-plus years (without the Royals) has been $306 million. Over the last decade, seven sales have averaged $900 million in profits.

We can get a more accurate representation of the numbers above by including inflation and the number of years owned to show annual appreciation of the franchise when sold. In that context, with much of this information first published two years ago when the Marlins were rumored to sell, the biggest profit in MLB history still belongs collectively to the MLB owners when they bought the Expos and then sold them as the Nationals.

The average yearly appreciation when a franchise is sold whether weighted by year or just taking the average of 33 sales is pretty close to 8% per year after inflation. The Royals would sit above that mark at 10.7% and would move half a percent if the sale were as low as $900 million or as high as $1.1 million. This number is right in line with the 10% figure from the seven sales in the last decade. For David Glass, John Sherman, and the rest of MLB, this sale is essentially business as usual for a sport with rising revenues, profits (with the Braves’ semi-open books a good example), and increasing franchise valuations. The proposed television deal is a little murkier.

Many details are missing from the potential television contract, but according to Jeffrey Flanagan:

An offer from FSKC was presented in May, according to sources. A new deal, likely in the 10- to 15-year range, is expected to bring the Royals somewhere near the $48-52 million range per year in rights fees.

The piece mentions that three years ago, the Reds got a new 15-year deal for between $55 million and $60 million. While the annual dollar figures might appear close, the differences between the lower-end Royals number and the higher-end Reds number amounts to $180 million over 15 years and potentially $420 million in expected revenue if the Royals’ new deal is for only 10 seasons. One of the unknowns in the Royals deal is whether the club received an ownership stake in the network. The Reds received one in their contract, which pumps up the potential revenue and keeps that money from revenue sharing.*

*Keeping revenues away from MLB’s pool helps small market teams as well as their larger peers, as it potentially increases the amount of money they receive from revenue sharing.

Compare the Reds deal to the Rays’ recent billion-dollar contract. Tampa Bay received no ownership share, but they did receive a 15-year deal that will pay, on average, $82 million per year. If the Royals are going to get less money than the Reds and not receive a stake in the network, that’s a huge step back from even the most recent contracts. While $50 million per year seems like a big increase over the $25 million they received this season, if that money goes gradually upward over 15 years, the difference next year could be as little as $10 million compared to this season. (An annual six percent increase over a 15-year deal worth $750 million would put 2020’s payout at $35.7 million, while a 4% annual increase would make next year’s sum $41 million.)

The other unknown in this deal is whether the Royals are surrendering their potentially very valuable local streaming rights. In multi-year pacts that expired last season, networks were paying $2 million per team for local streaming rights. At that time, there were rumors that MLB would cede control of those rights to the individual teams. New deals were made for the FOX RSNs as well as AT&T and Comcast, but some of those deals covered just a single season due to the uncertain nature of the future ownership of many of those same networks. There is considerable value in local streaming rights now and the value into the future is even greater as more and more homes move on from cable or never have cable in the first place.

RSN deals of the past have essentially had exclusive local broadcast rights, but increases in technology and consumer awareness regarding other options leave teams able to compete locally/extract significant revenue from networks should the deals go astray. One way to avoid these issues is to give a team an ownership stake in the network. Another way is to have the network pay handsomely for the valuable streaming rights. If the Royals have done neither and taken a below-market deal, it raises questions about the motivations of such a contract.

With a team potentially for sale, no long-term television deal would be a huge uncertainty that might cause reluctance in potential buyers. Having a deal in place, even one that is a little below market, helps provide the revenue certainty that a buyer might want to move forward. The Royals were reportedly made an offer in May, which coincides with Sinclair’s announced purchase of the old FOX RSNs, and this recent report comes right after the sale was closed. The Royals’ contract with FS Kansas City is up at the same time as the Brewers’ with FS Wisconsin (the Pirates’ deal with AT&T is also up), yet we’ve heard no rumblings about a deal being close with the Brewers. That this happened so close to the sale of the RSNs and the rumored sale of the Royals makes it appear as though the deal was more of a priority for the Royals than Sinclair. Whether the deal remains as in favor of Sinclair will depend on the ownership and streaming details, but the dollar amount is lower than what we might have expected given previous deals.

Craig Edwards can be found on twitter @craigjedwards.

Question for Kansas City-ites (Kansas Citians?): what would be the competition for FS Kansas City in terms of local broadcast rights? Is there another Kansas City RSN with the resources to match or exceed a $50mm a year deal? It seems like it would be hard to start a bidding war in such a small media market.

I am not a resident of Kansas City, but scanning a list of RSN’s gives me one logical name: Spectrum Sports Kansas City (owned by Charter), whose current flagship programming is Kansas men’s basketball.

Outside of a few big markets where there are multiple RSN’s (due to multiple teams in MLB, NBA, and/or NHL), I think the bigger leverage for teams in these negotiations is the possibility another operator will come into the market via baseball broadcast rights to launch an RSN. And, comparing to the other recent TV deals that Craig mentioned in this article, I don’t see why the Reds or Rays would have much (if any) more leverage in negotiations than the Royals.